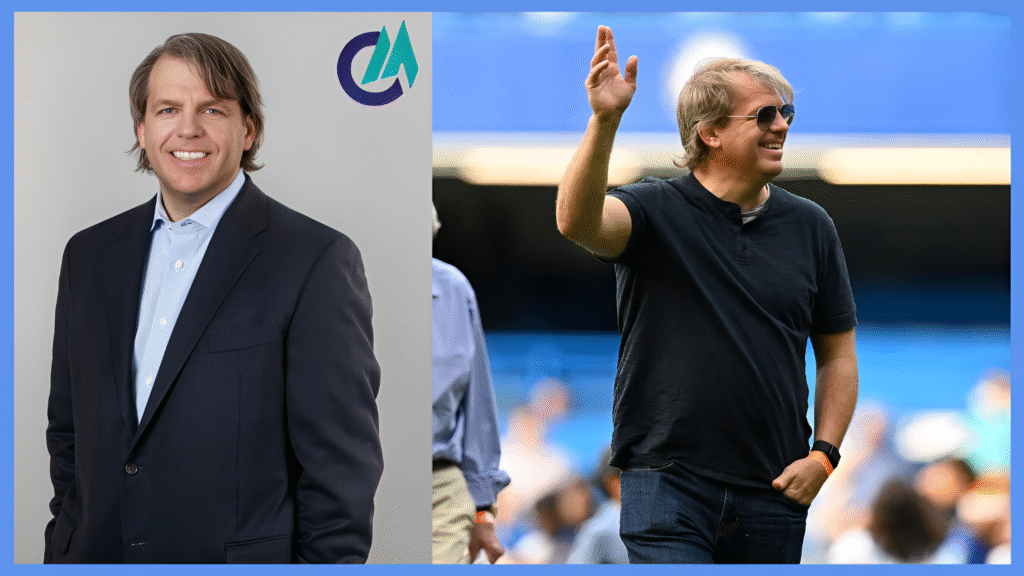

Todd Boehly has emerged as one of the most influential figures in modern sports ownership and global investing. As the co-founder and CEO of Eldridge Industries, he has shaped a wide-ranging business empire spanning sports, real estate, media, finance, and other major sectors. His roles with the Los Angeles Dodgers and Chelsea Football Club, combined with a growing portfolio of high-value investments, have firmly established him as a significant force in international business. The following article explores his early life, career path, financial growth, involvement in world-class sports franchises, and the personal side of the man behind the headlines.

Early Life and Education

Todd Boehly was born on September 20, 1973, in Fairfax County, Virginia, and grew up in a grounded, middle-class household. His grandparents had immigrated from Germany, and his parents built their lives around steady, practical careers — his father worked as an engineer. At the same time, his mother devoted herself to teaching first-grade students. During his school years, Boehly explored a range of interests before gradually finding himself drawn to finance. As his interest in finance deepened, it influenced the direction of his studies. It ultimately led him to complete a Bachelor of Business Administration at the College of William & Mary. He later broadened his perspective even further by studying at the London School of Economics, where he strengthened his understanding of global markets and economic systems.

That mix of education, drive, and curiosity gave him a solid springboard into the world of finance and later opened the door to the wide-ranging investments and major sports ownership roles he would eventually take on.

From Finance to Founding Eldridge Industries

Boehly’s career began in traditional finance, where he spent his early years at firms such as Citibank and Credit Suisse First Boston, learning the fundamentals of banking and investment firsthand. His path took a significant turn in 2001, when he joined Guggenheim Partners, where he played a key role in building the company’s credit investment division before rising to president.

In 2015, Boehly drew on his financial expertise and the network he had built over the years to launch Eldridge Industries. He brought together a range of assets he had acquired during his time at Guggenheim — including media companies and various strategic investments — and reorganized them into a fresh, multi-sector holding company. Under his leadership, Eldridge grew rapidly, expanding into technology, real estate, sports, media, insurance, and asset management. This broad, calculated expansion transformed Eldridge into a powerful, highly versatile conglomerate, with Boehly serving as its Chairman, CEO, and primary decision-maker.

Estimated Net Worth and Wealth Sources

Boehly’s wealth is mainly tied to his significant ownership stake in Eldridge and to investments in several major sports franchises. Over the years, these ventures have steadily increased his financial standing, placing his personal net worth at an estimated US$8.86 billion in 2025.

A large share of Boehly’s wealth comes from Eldridge’s broad portfolio, spanning asset management, media, real estate, and various technology ventures. Beyond that, his involvement in multiple sports franchises — spanning baseball, basketball, and soccer — adds another layer to both his financial strength and his visibility on the global stage.

Over the years, Boehly has consistently reinvested his returns and broadened his portfolio with careful, forward-looking decisions. This steady, strategic approach has helped his wealth continue to grow, even as markets shift and evolve — a clear reflection of his long-term vision and willingness to take calculated risks.

Role and Impact with the Los Angeles Dodgers

One of the most notable pieces of Boehly’s sports portfolio is his stake in the Los Angeles Dodgers. Through Eldridge and various investment partnerships, he holds a share of the Major League Baseball franchise, placing him among the key figures behind one of the sport’s most successful teams.

Under his leadership, the Dodgers have continued — and, in many ways, enhanced — their reputation as one of the strongest and most valuable teams in Major League Baseball. The combination of Boehly’s wider business outlook and the team’s competitive drive has created an environment where smart financial decisions and on-field success work hand in hand. Although many of the internal operational choices during his tenure aren’t publicly detailed, the team’s consistent performance and growing commercial value make it clear that his stewardship has been steady and effective.

The Dodgers’ continued success boosts Boehly’s wealth while also strengthening his image as a committed, long-term sports investor who focuses on lasting results rather than quick publicity.

Taking Over Chelsea FC: Leadership, Challenges, and Vision

One of the most significant moments in Boehly’s sports-ownership journey came in 2022, when he led the BlueCo consortium in acquiring Chelsea Football Club. The multibillion-dollar deal represented an important turning point for the Premier League side, ushering in a new era of leadership and signaling one of the most notable ownership transitions in modern football.

As a result of the takeover, Boehly stepped in as both co-owner and Chairman of Chelsea, placing him at the heart of the club’s strategic decisions. His role gives him significant influence over how the team is managed, how it operates behind the scenes, and the long-term vision that will guide one of England’s most prominent football institutions.

From the beginning, the Chelsea takeover carried a wave of anticipation. Boehly’s work with the Dodgers and his leadership at Eldridge suggested he had the structure and financial strength to modernize the club’s operations. Still, the transition hasn’t been without obstacles. He has had to manage the tension between heavy investment, the expectations of a passionate fan base, and the responsibility of preserving the identity and traditions of a long-established football institution.

Despite the challenges, Boehly’s direction for Chelsea seems firmly rooted in long-term thinking. His leadership has already brought several structural changes to the club, with an emphasis on creating lasting financial strength and building a team capable of sustained competitiveness rather than chasing quick, short-lived wins.

Personal Life — Family and Lifestyle

Even with his worldwide business influence and prominent role in major sports franchises, Todd Boehly keeps his personal life mostly out of the spotlight. He and his wife, Katie, have three children together.

His modest, hardworking, middle-class upbringing is a stark contrast to the billionaire life he leads today. Those early experiences helped keep him grounded and likely shaped the balanced mix of practicality and ambition that now defines his approach to business.

Although little is publicly shared about his personal real estate portfolio, it’s widely understood that he owns several high-value properties, reflecting both his financial success and his broad investment approach.

Business Philosophy and Broader Investments

One of the key qualities that sets Boehly apart is his commitment to diversification. Instead of focusing on a single field, he has diversified his investments across a wide range of sectors — including asset management, media, real estate, technology, and sports.

This approach helps him offset fluctuations in one area by relying on steadier returns in others — a method that proves valuable when markets become unpredictable. His leadership at Eldridge gives him the freedom to move capital efficiently, react quickly to new opportunities, and maintain a long-term perspective in his investment decisions.

His background in traditional finance — spanning roles in banking and credit — has given him a solid analytical base. He has a clear grasp of risk, leverage, and market cycles, strengths that many sports-team owners typically don’t bring to the table.

Legacy and Future Outlook

Not yet in his mid-50s, Boehly has already accomplished what most people never come close to — creating a multibillion-dollar investment empire, securing ownership roles in major sports franchises, and establishing himself as a significant figure in global business.

For Chelsea, his arrival signals the start of a new chapter — one driven by practical business thinking and a broad international vision. If he manages to navigate the pressures of competition, meet the expectations of supporters, and build long-term stability, he could reshape what modern ownership looks like for a major European football club.

At the same time, Eldridge’s diverse portfolio shows that Boehly is building for long-term stability, well beyond the ups and downs of the sports and entertainment world. His investments in real estate, media, finance, and technology act as solid pillars that support his broader financial strategy.

His journey — from a modest childhood in Virginia to top-tier education and eventually worldwide business influence — reflects a blend of ambition and steady discipline. In an era where fortunes can shift overnight, Boehly’s thoughtful, diversified approach may be the key to ensuring his impact lasts well into the future.

Conclusion

Todd Boehly represents the intersection of high-level finance, significant sports ownership, and global investment strategy. Through Eldridge Industries, he oversees a wide range of businesses spanning multiple sectors, and his roles with the Los Angeles Dodgers and Chelsea place him at the center of two of the world’s most-watched sports. Yet despite the wealth and influence he has accumulated, he still comes from humble beginnings — a reminder of how far steady planning, intelligent risk-taking, and consistent effort can carry a determined person.

As Boehly guides Chelsea into a new chapter and continues broadening his business footprint, he stands out as one of the most closely followed figures in both global business and professional sports. His wealth, family grounding, and wide-ranging investments all point to an influence that isn’t temporary but built to last for decades.

Read More: Parag Agrawal: Net Worth, Age, Education, Twitter CEO to Elon Transition, Salary, Family & Current Job.