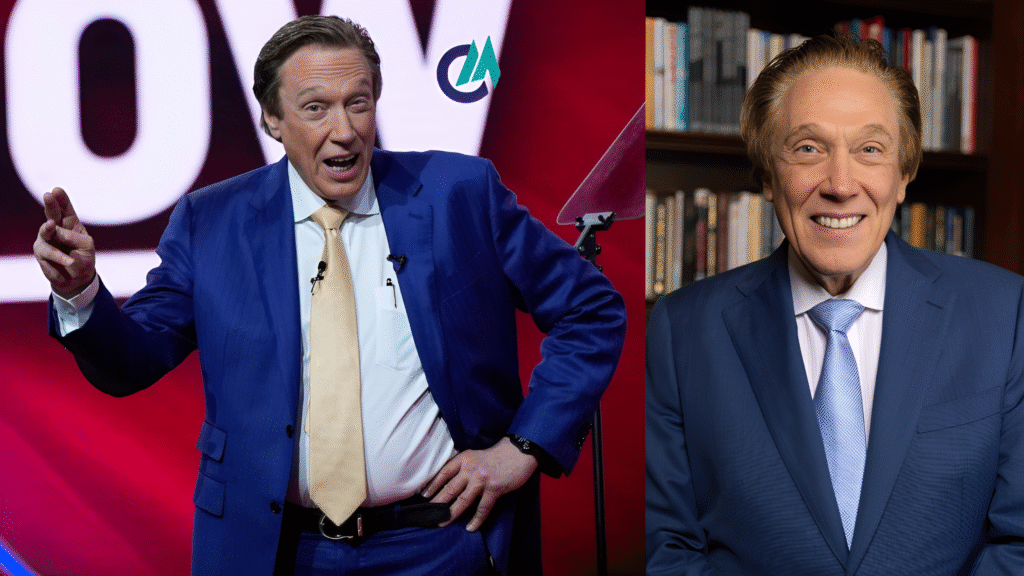

Perry Johnson is a seasoned American entrepreneur whose career spans decades of building, guiding, and scaling businesses across multiple industries. He is widely regarded for his steady leadership style, disciplined operations, and focus on sustainable, long-term growth rather than short-term gains. Over time, his name has become closely linked with strong executive judgment, organizational precision, and diversified business development. More recently, attention has extended beyond his leadership credentials to encompass interest in the Perry Johnson Mortgage Company and evaluations of Perry Johnson’s net worth, thereby offering a broader perspective on how leadership decisions, company performance, and financial outcomes are interconnected throughout his professional journey.

Early Life and Professional Foundation

Perry Johnson was born in Dolton, Illinois, where he developed a natural curiosity for logical thinking and structured problem-solving at an early age. His studies in mathematics and economics sharpened his analytical approach and instilled a disciplined way of evaluating complex challenges. At the start of his career, Johnson gravitated toward consulting and organizational development, gaining firsthand insight into how businesses succeed or struggle based on leadership cohesion, process structure, and execution standards. These formative experiences laid a strong foundation for his later ventures and shaped the core principles that would guide his decision-making throughout his career.

Instead of chasing quick wins, Johnson focused on building scalable systems and business models that could be applied repeatedly without losing effectiveness. This patient’s long-term mindset enabled him to move into different industries while maintaining clear standards and operational consistency across his ventures. Over time, his professional journey evolved naturally, reflecting a shift from hands-on technical work to broader executive leadership, ultimately defining his transition from consultant to enterprise builder.

Business Leadership Philosophy

One of the most recognizable aspects of Perry Johnson’s leadership style is his intense focus on structure, responsibility, and reliable performance. He has consistently held the view that lasting growth comes from pairing clear leadership direction with well-designed operational systems. This belief shaped his early consulting work and gradually became a defining factor in how his companies were organized, guided, and scaled.

Johnson’s approach to leadership reflects a careful balance between big-picture strategy and attention to day-to-day operations. He places strong importance on setting clear goals, tracking real results, and refining processes over time. Equally important to him is the ability to adjust when conditions change, particularly in industries shaped by shifting economic realities and evolving regulations. This blend of structure and adaptability has enabled his businesses to remain resilient and competitive, and to grow into new markets without losing focus.

Overview of Perry Johnson Mortgage Company

The Perry Johnson Mortgage Company operates in the residential mortgage services space, assisting individuals and families through the often complex process of securing home financing. It offers organized guidance for those looking to purchase property or adjust existing financial commitments. Although separate from Johnson’s early consulting work, the company clearly reflects the same core principles that shape his wider business philosophy, particularly around structure, clarity, and client-focused operations.

The organization places strong emphasis on clear communication, efficient processes, and service centered on client needs. These priorities matter greatly in an industry where complexity and uncertainty can easily overwhelm consumers. By streamlining procedures and maintaining open, straightforward communication, the company works to make the experience more approachable and manageable for clients at every stage of homeownership.

Operational Approach and Service Focus

The operational setup of Perry Johnson Mortgage Company is designed for reliability and quick response. Emphasis is placed on well-organized workflows, precise documentation, and consistent communication throughout each stage of the process. By keeping these fundamentals in focus, the company works to minimize delays and prevent the misunderstandings that often arise in the mortgage industry.

Client engagement sits at the heart of the company’s approach. Considerable effort is made to clearly explain each procedure, outline expectations upfront, and support clients at every stage of the journey. This reflects Johnson’s long-standing belief that trust and openness are the foundation of lasting business success. Instead of focusing purely on transaction volume, the company prioritizes building strong relationships and delivering consistent, dependable service over time.

Business Expansion and Market Presence

Perry Johnson’s professional path reflects a clear preference for steady, intentional growth over rapid expansion without direction. His companies tend to evolve through thoughtful planning and well-built systems, ensuring each stage of development is supported before moving forward. This measured approach enables operational consistency while adapting to different markets and geographic regions.

The mortgage company benefits from this strategic mindset by operating within a framework that prioritizes sustainability over aggressive expansion. This measured growth model helps maintain service quality and organizational stability, even as market conditions evolve. Johnson’s broader experience managing complex enterprises strengthens the company’s ability to adapt while remaining aligned with its core objectives.

Revenue Structure and Business Economics

Although detailed financial figures for privately held companies are generally not publicly disclosed, mortgage service businesses typically generate revenue from transaction activity, efficient operations, and long-term client relationships. Perry Johnson Mortgage Company operates within this model, placing strong emphasis on refining internal processes and maintaining high client satisfaction, both of which are key contributors to its overall financial performance.

Johnson’s track record of building successful businesses demonstrates a deep understanding of cost management, operational efficiency, and practical performance evaluation. These elements are critical to sustaining profitability and ensuring long-term stability. His leadership experience reinforces a disciplined approach to financial oversight, paired with thoughtful and deliberate allocation of resources to support continued growth.

Perry Johnson Net Worth Analysis

Perry Johnson’s net worth has drawn considerable attention, mainly due to the breadth and scale of his business ventures. Estimates commonly place his personal wealth in the several-hundred-million-dollar range, a figure shaped by many years of building and owning companies across different sectors. This valuation reflects not only the size of his enterprises but also the consistency of their performance and the long-term value created through sustained leadership and strategic growth.

Net worth evaluations are shaped by factors such as how companies are valued, the strength of their revenue streams, ownership of intellectual assets, and the impact of long-term investments. In Johnson’s situation, operating across a wide range of businesses helps limit dependence on any single market, adding a layer of financial stability. His presence in both service-oriented ventures and system-based enterprises further strengthens the durability and balance of his overall financial profile.

Relationship Between Leadership and Personal Wealth

Perry Johnson’s financial position is closely tied to how he leads and builds organizations. By focusing on strong operations and long-term planning, he has developed businesses that deliver steady value year after year. This approach stands in clear contrast to short-term tactics that may bring quick results but often fail to hold up over time.

His personal wealth represents more than strong company results; it also reflects careful decision-making, thoughtful risk management, and a consistent willingness to reinvest in long-term growth. Instead of chasing immediate payoffs, Johnson has focused on building organizations that remain valuable and relevant as markets evolve and conditions change.

Public Perception and Industry Standing

Within professional circles, Perry Johnson is widely viewed as a precise and methodical business leader. His work in shaping organizational systems and guiding enterprise development has helped influence how many companies think about structure, accountability, and performance. This long-standing reputation strengthens his credibility across multiple industries, including the mortgage services sector.

Public perception of Johnson’s success is shaped not only by financial results but also by the consistency of his professional conduct over time. His ability to remain relevant across decades points to a leadership style grounded in adaptability and ongoing refinement, rather than decisions driven by short-lived trends or passing market pressures.

Challenges and Strategic Adaptation

Like any experienced business leader, Perry Johnson has navigated challenges tied to shifting markets, regulatory demands, and the complexity of managing diverse operations. Leading companies across multiple sectors require ongoing assessment and thoughtful adjustment. His sustained success highlights an ability to respond to these pressures through careful planning, informed analysis, and strong organizational alignment.

Strategic adaptation has been a consistent thread throughout his career. Instead of responding to change with impulsive decisions, Johnson’s organizations tend to evolve through deliberate strategy adjustments and careful refinement of internal processes. This thoughtful approach helps reduce risk while maintaining stability and balance within the organization.

Future Outlook

Looking forward, the trajectory of Perry Johnson’s business interests appears focused on steady continuity and long-term performance. The core principles that have shaped his career—clear structure, thoughtful planning, and purposeful growth—continue to hold value as markets evolve. Within this framework, Perry Johnson Mortgage Company is positioned to move forward, emphasizing reliable operations and consistently high service standards.

As markets continue to evolve, experienced leadership and well-structured management systems remain critical strengths. Johnson’s career illustrates how a disciplined, systems-driven approach can help organizations endure change while maintaining long-term stability and financial resilience.

Conclusion

Perry Johnson‘s career shows how leadership mindset, organizational structure, and financial results are deeply interconnected. Over many years of building and guiding enterprises, he has created organizations shaped by discipline, consistency, and a clear long-term vision. Those same principles apply at Perry Johnson Mortgage Company, where they are implemented in a service-focused environment that prioritizes clarity, trust, and meaningful client engagement.

Estimates of Perry Johnson’s net worth indicate more than financial achievement; they highlight a pattern of steady decision-making and diversified expansion over time. His career demonstrates how consistent leadership and a long-term perspective, rather than chasing short-lived trends, can build enduring business value and lasting financial stability.

Read More: Delores Nowzaradan: Age, Net Worth, Personal Life, and Her Role as Dr. Nowzaradan’s Former Wife.